Summary

Q3 2025 digital advertising trends reveal a clear pattern: the most successful marketing teams used the quarter to prepare, not just perform. With economic uncertainty ahead, marketers doubled down on disciplined strategies—tightening data infrastructure, refining full-funnel retail media plans, and proving that scale and efficiency can coexist during peak events like Prime Big Deal Days. Retail media, paid search, and paid social all grew smarter, not just bigger.

Download the full Q3 2025 Quarterly Trends Report now

Q3 isn’t the showtime quarter. Instead, it’s when the best teams build the infrastructure that carries them through what comes next.

While Q1 is for testing new tactics and Q2 is about turning efficiency gains into repeatable systems, Q3 is where you stress-test everything: data hygiene, pacing frameworks, automation guardrails, and feed accuracy. This is the unglamorous work that separates teams that scale efficiently during peak demand from teams that spend the season troubleshooting instead of optimizing.

This quarter’s reality check came from economic forecasts signaling that consumer spending growth will slow in 2026 after holding relatively strong through 2025. That means Q3 was a balancing act for most marketers where they prepared aggressively for holiday demand, but with boundaries, and scaled what has been working, but with discipline. After all, the margin for waste is shrinking.

Drawing from over 1 trillion impressions, 8.6 billion clicks, and $8.9 billion in spending across retail media, paid search, and paid social, this quarter’s analysis reveals what actually happens when marketers get serious about preparation. The teams winning right now aren’t the ones spending the most; they’re the ones that prepared the best.

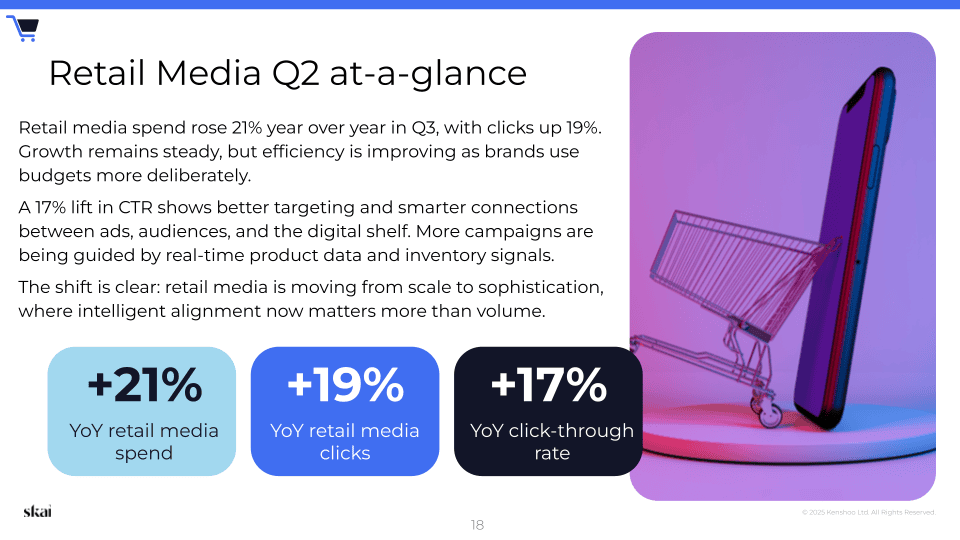

Retail media’s growth story has entered a new phase

Spend rose 21% year over year, with clicks climbing 19%. That parallel growth signals something important: engagement is keeping pace with investment. Costs barely budged. Click-per-click fees edged up just 2%, the smallest increase in several quarters.

But here’s where it gets more interesting: The money isn’t flowing evenly. Offsite DSP formats and full-funnel strategies are commanding larger shares of budget. Marketers aren’t just buying lower-funnel clicks anymore – they’re building connected customer journeys that reach people earlier, move them through consideration, and close conversions at the moment of purchase.

Amazon and Walmart expanded their share of total retail media investment, while growth across smaller networks slowed. This signals a strategic shift: the testing phase is giving way to focus and efficiency within platforms that have proven their ability to scale.

The efficiency story becomes clearer when you look at costs by format. Sponsored Products CPCs held steady around $1.06, while Offsite Display and DSP costs edged down to $1.58. That narrowing gap suggests a maturing market where brands are gaining confidence in layered, full-funnel approaches rather than betting everything on a single format.

Download the full Q3 2025 Skai Quarterly Trends report now

Prime Big Deal Days proved efficiency and scale can coexist

Amazon’s October shopping event, held October 7-8, delivered something most marketers assume is impossible: click-through rates surging 74% year over year while costs remained stable. This wasn’t a tradeoff; it was a breakthrough.

CPC fell to $1.80, the lowest in three years. CTR hit 0.32%, the highest in three years. The pattern challenges a fundamental assumption about peak demand periods: that higher traffic automatically means higher competition, which automatically means higher costs. It doesn’t have to be that way.

The consumer behavior during the event tells part of the story. Consumers prioritized essentials and deals over early holiday gifts. Average order value sat at $45.42, with most orders under $20. Only 23% of purchases were classified as holiday gifts. People weren’t shopping aspirationally – they were shopping practically, comparing prices across retailers and looking for value.

For teams preparing Cyber 5 campaigns, the lesson is straightforward: efficiency is achievable if campaigns are well-prepared and inventory is aligned with what consumers actually want. More than that, the two-day format created an unexpected advantage. Extended windows let teams adjust bids, shift budgets, and test creative mid-flight. That flexibility is impossible during a single 24-hour sprint like traditional Black Friday. Build your Cyber 5 campaigns with enough granularity to make hourly or daily adjustments rather than locking in a single strategy for the entire period.

Paid search remains your high-intent anchor, despite rising costs

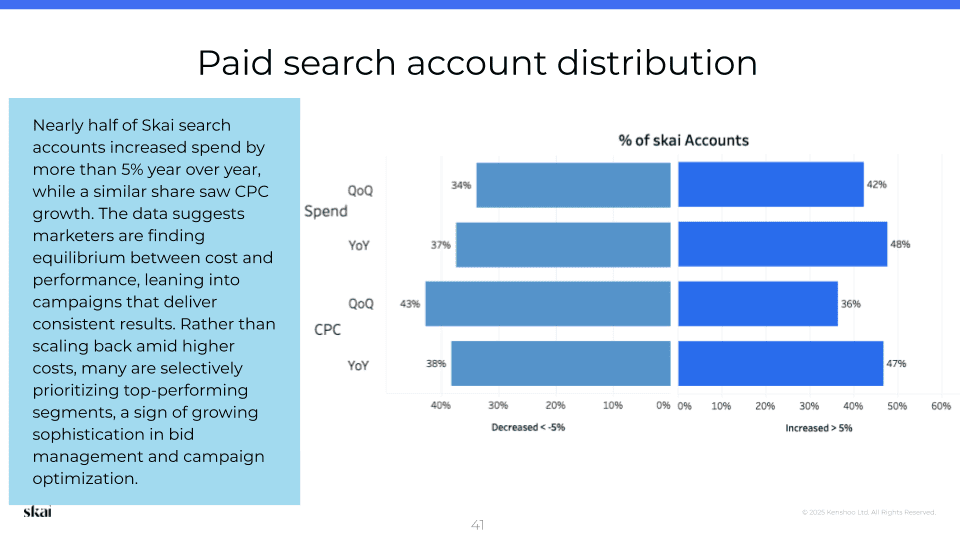

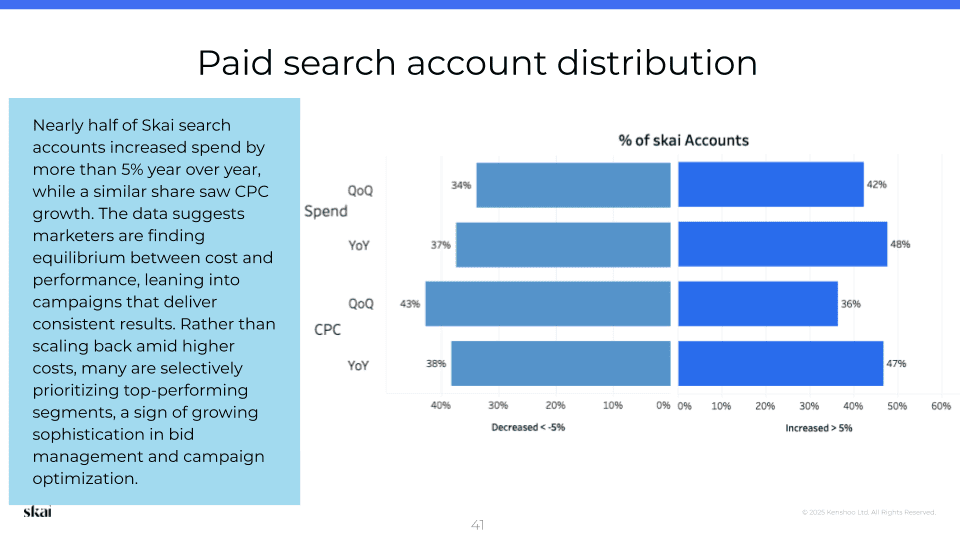

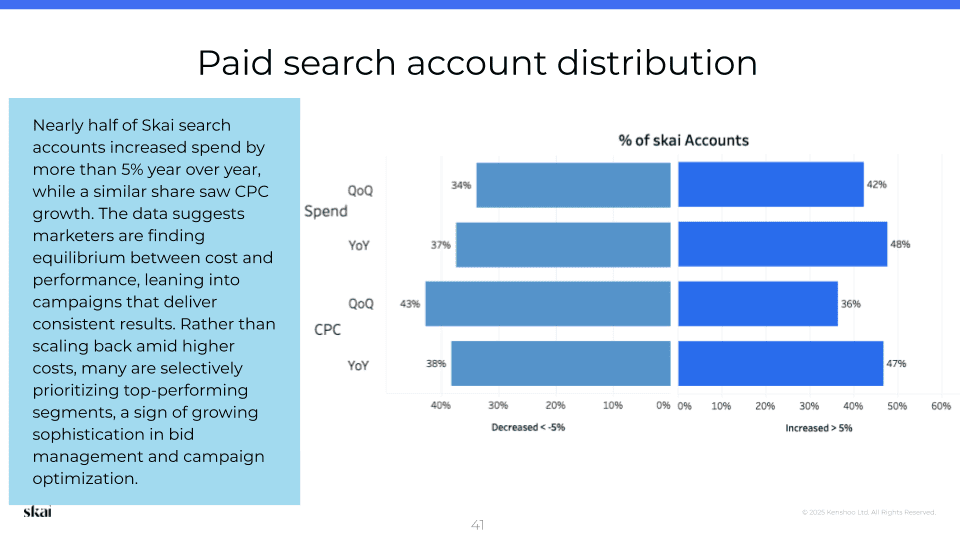

Spend climbed 9% year over year, with clicks holding flat at 0% growth and CPCs rising 9%. The pattern reflects something worth understanding: marketers are willing to pay more where performance justifies the cost. Engagement isn’t slipping. Value per click is simply getting higher.

Nearly half of search accounts increased spend by more than 5% year over year, while a similar share experienced CPC growth. Rather than pulling back amid higher costs, teams are getting more selective. They’re doubling down on high-performing segments and letting lower-performing ones contract. It’s disciplined, not desperate.

The category dynamics reveal strategic priorities. Health led all industries with 20% year-over-year spend growth even as CPCs climbed 40%, showing that health advertisers are willing to pay premium prices to protect visibility where intent is strongest. Jobs and Education pushed harder, up 80% year over year with CPCs rising 50%, reflecting renewed demand for recruitment and training. By contrast, CPG and Travel brands are showing more restraint, likely testing whether search dollars deliver the direct sales impact they used to.

Performance Max adoption settled into steady use, remaining just above 60% of search accounts, with spend share holding at approximately 9%. Growth in adoption leveled off after several quarters of gains, but the consistency signals something worth noting: marketers view this format as reliable infrastructure now, not a growth experiment. It’s confidence without aggressive reinvestment.

Paid social finally stabilized

Paid social spend increased 11% year over year. The real story is what happened beneath that number: clicks and impressions both rose 18%, while CPMs declined 5%. Platforms have worked through delivery inefficiencies and are now delivering consistent, scalable performance again. Marketers are comfortable scaling budgets here.

TikTok continues its deliberate climb. 46% of advertisers are now active on the platform with 13% of paid social spend directed there, representing steady growth from previous quarters. This isn’t experimental spending anymore. It’s becoming standard.

The category concentration in social advertising reveals an interesting split. Jobs and Education surged ahead with approximately 80% year-over-year growth in spend. Finance and Vehicles followed, both showing healthy momentum as advertisers in these sectors continued prioritizing visibility and lead generation. Meanwhile, CPG and Consumer Goods appear to be reallocating spend toward retail media, where performance signals are stronger. The gap in CPMs between high-intent categories and efficiency-focused segments suggests social is evolving into two distinct approaches: one focused on volume and reach, the other on precision and qualified audiences.

Conclusion: The teams that prepared in Q3 will scale in Q4

Q3 delivered clear momentum across all channels. Retail media spend rose 21% with clicks up 19%. Paid search remained steady with 9% growth despite rising competition. Paid social rebounded with 11% spend growth and improved efficiency. Prime Big Deal Days proved that efficiency and scale can coexist when campaigns are prepared. Across the board, one pattern stands out: marketers aren’t waiting to see what happens. They’re adopting DSP at record rates, expanding into new formats, and using AI tools to accelerate strategic decision-making.

The question for your team now is simple: did you use Q3 to build infrastructure, or did you treat it as just another quarter? The answer will determine how much of Q4 you spend optimizing versus troubleshooting.

Skai is the AI-driven commerce media platform for performance advertising. For nearly two decades, the world’s top brands and agencies have trusted our technology to bring retail media, paid search, and paid social together into a single, strategic commerce media program. With embedded AI, connected data, and automation throughout, Skai helps marketers move faster, make smarter decisions, and drive more meaningful growth.

Ready to see how the platform works? Schedule a quick demo.

And download the full report now: https://skai.io/reports-and-whitepapers/q3-2025-quarterly-digital-trends-report/

Frequently Asked Questions

Q3 2025 digital advertising trends show growth in retail media, stable paid search, and improved social efficiency. Marketers focused on building infrastructure, preparing for Q4 with automation, connected data, and full-funnel strategies

Retail media spend rose 21% with clicks up 19%, while CPCs stayed nearly flat. Brands prioritized offsite DSPs and full-funnel strategies to build customer journeys and scale performance effectively.

Efficient campaigns can scale during peak events. CPCs dropped while CTR rose 74%. Success came from aligned inventory, flexible bidding, and real-time adjustments across the two-day event.