Chris "Coz" Costello

Senior Director of Marketing Research @ Skai

Chris "Coz" Costello

Senior Director of Marketing Research @ Skai

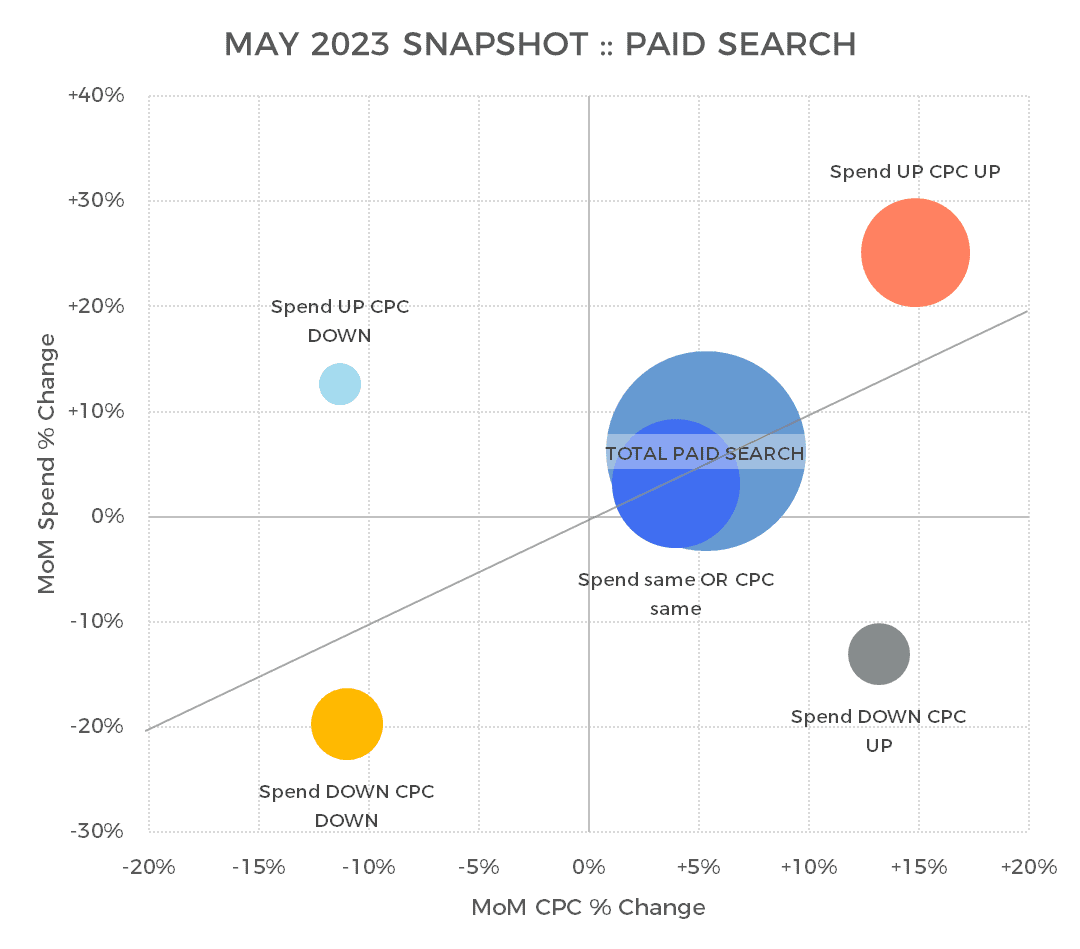

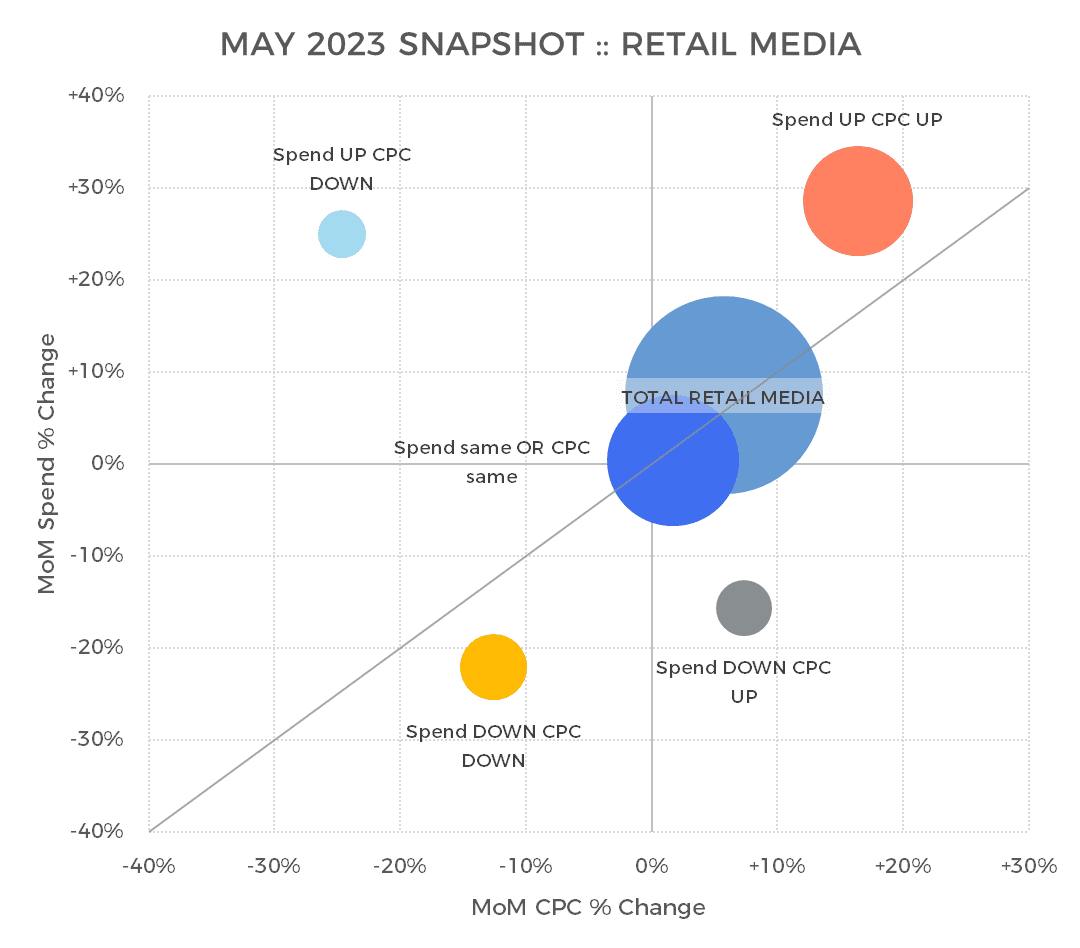

April showers brought more spending in search and retail media in May, with total expenditures up 6% in both channels. Much of this increase was from higher ad prices, with CPC up 5% for search and 6% for retail media.

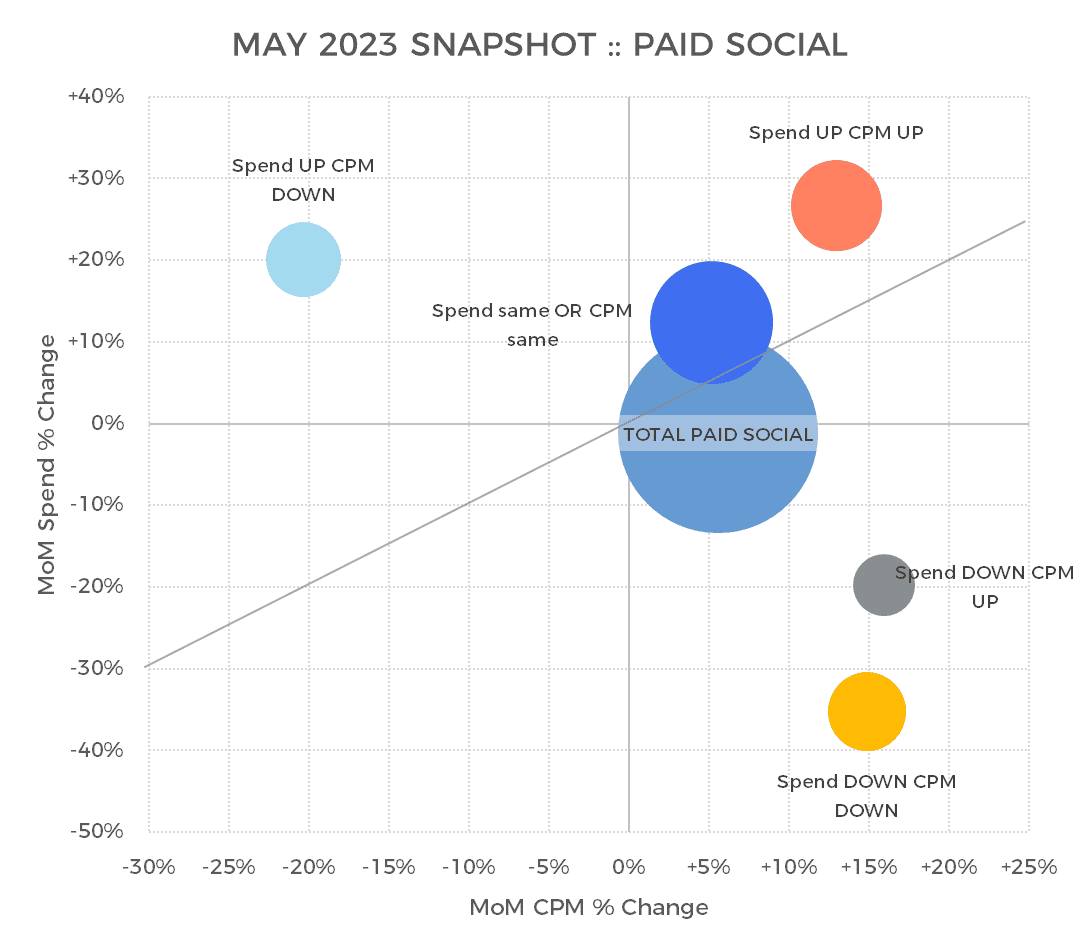

Paid social ad spending was down 1% in May, although CPM did regain some of the ground it lost last month, rising by 6%.

How do you measure up? Check out these benchmarks to see if your programs are on par with your industry peers or if you’re ahead or behind the curve.

This is a continuation of our monthly paid media snapshot series. As with any benchmark, your mileage may vary, but we hope this provides a bit more context for you as a marketer as you navigate the ups and downs of your program’s performance.

Methodology: For these benchmarks, only Skai accounts with spend above a minimum threshold for the previous three months are included. Starting with the January 2023 release, spending benchmarks will once again use total monthly spend to ensure consistency across chart segments. Please note that the selection criteria used here are different from the Skai Quarterly Trends Report, and as a result may not be consistent with those results in all cases.

How to read these charts.

Accounts are divided into four segments based on increases or decreases of at least 5% in monthly spending and CPC for retail media and paid search or CPM for paid social. Those segments are then plotted on a bubble chart where the x-axis represents the month-over-month (MoM) percent change in pricing for that segment, and the y-axis is the MoM percent change in total spending. Bubble size represents the percent of total Skai accounts.

The diagonal line indicates spending changes that are completely described by the change in pricing. Bubbles above the diagonal mean that ad volume—clicks for retail media and paid search, impressions for paid social—grew faster than pricing, while bubbles below the diagonal mean that volume grew slower.

Overall paid search spending grew 6% in May, while average CPC increased 5%. Average spending per day rose 3%.

Overall, paid social spending dropped 1% in May, while average CPM grew 6%. Average spending per day dipped 4%.

Overall, retail media spending grew 7% in May, while average CPC increased 6%. Average spending per day rose 4%.

Check out more resources from Skai

Check out more resources from SkaiCome back next month for the most up-to-date data. Until then, you can dive into more of our research via our Quarterly Trends Reports hub.

And please visit the Skai blog and Research & Reports page for ongoing insights, analysis, and interviews on all things related to digital advertising.

We use cookies on our website. Some of them are essential, while others help us to improve this website and your experience.

Here you will find an overview of all cookies used. You can give your consent to whole categories or display further information and select certain cookies.