Black Friday is one of the biggest shopping events of the year where thousands of businesses promote some of the biggest discounts following Thanksgiving to gear up for the Christmas season. In this blog, we give you the data, insights and results you need to stay ahead of the curve for Black Friday.

TABLE OF CONTENTS

- What Is Black Friday?

- Why are Black Friday results important for ecommerce?

- What is Black Friday Data?

- Black Friday 2021

- Black Friday 2020

- Black Friday 2019

What is Black Friday?

Black Friday is the descriptive term for the Friday after Thanksgiving, a day that unofficially kicks off the holiday shopping season in the United States. Traditionally, stores and brands have offered discounts on products and merchandise, some that were time sensitive for early shoppers or specific time increments.

Why are Black Friday results important for ecommerce?

Black Friday has now claimed the title of the biggest online shopping day of the year. Retailers and advertisers spent more, and shoppers bought more, across channels, on the day after Thanksgiving then on the following Monday.

Based on aggregated data for brands managing their digital advertising through the Skai platform during the Cyber Five, marketers invested more on Black Friday than on Cyber Monday this year. This includes key digital channels: retail media, paid search, and paid social.

While some will portray this as a disruption caused by the continued global pandemic and supply chain bottlenecks, those factors only accelerated a trend that had been happening for years. Some history is probably in order. The reason Cyber Monday came about in the first place was that broadband internet was much more prevalent at the workplace than at home. So when people came back to their high-speed connections at work on Monday after the holiday season, they would pick up where they may have left off in stores on Black Friday.

What is Black Friday Data?

Ecommerce has been broadly expected to expand its share of total activity for the holiday season and continue to grow, and the Cyber 5 (Thanksgiving through Cyber Monday) is still expected to be the biggest Q4 sales period. However, with brands and retailers offering online promotions throughout the entire holiday season, the role of these key dates in the holiday calendar may be shifting.

Brands started increasing their investments in earnest at the end of October in digital advertising’s hottest channel. High-profile media stories about supply chain issues meant consumers would likely be shopping online earlier in the season to get ahead of potential inventory and shipping bottlenecks. Reaching those online shoppers at the point of purchase has become one of the more critical digital engagement points for consumer goods brands to prioritize.

Case Study: LG’s Revenue Jumps 71% On Black Friday & Cyber Monday With Amazon Advertising, iCrossing & Skai Read the case study.

Black Friday 2021

In the lead-up to the holiday shopping season, consumers reported that they would be shopping earlier than normal given the concerns over lack of inventory due to supply chain issues. Amazon research released in September showed that nearly half of consumers surveyed would begin their holiday shopping in October this year.

So, although total holiday spending this year is expected to break records, for the first time, Black Friday wasn’t as big as the previous year. Last year, consumers spent $9 billion on the day; this year, just slightly less at $8.9 billion.

Retail media ads continued to build throughout November toward its expected peak during the holiday weekend. The first two days give us some idea how the whole weekend will perform. Ad spending on Thanksgiving increased 69% compared to the daily average from November 1 through November 24 (the day before Thanksgiving). Last year was 63% higher versus the same period. Black Friday spending jumped 168% (2.7x) compared to that pre-Thanksgiving November average, compared to a 206% increase for the same period last year.

Ad prices were one component of the spending increase, with Thanksgiving cost-per-click up 26% and Black Friday CPC up 35% compared to the rest of November. Last year saw less price inflation on Thanksgiving (+18%) and more on Black Friday (+45%).

Revenue in the retail media channel also grew compared to the rest of the month, with advertiser revenue on Thanksgiving up 44% and Black Friday increasing 191%, both compared to the daily average for November. On the higher-volume Black Friday, this means return on ad spend actually improved on the day.

The average daily spend for November 1 through the day before Thanksgiving grew 16%, while spending on Thanksgiving grew 35% and Black Friday was up 6% YoY. This is consistent with the notion that high-profile store closures on Thanksgiving day could lead to more online shopping on the day, while some return to in-store shopping could limit growth on Black Friday itself.

Average CPC showed very similar behavior, up 16% YoY for pre-holiday November, up 28% for Thanksgiving and rising by 8% on Black Friday.

Find out the complete Black Friday 2021 results here.

Black Friday 2020

On Black Friday, in-store retail traffic reportedly fell 52.1% versus in 2020. Although a drop was certainly expected, many experts didn’t project that shopping in-store would fall by quite that much.

But, the good news is that Americans spent 116.6 million hours shopping online on Black Friday. The sales lost in-store were made up with surging digital sales as consumers spent a record $9 billion online, up 21.1% year-over-year (YoY).

In fact, Black Friday 2020 was one of the biggest online shopping days ever, second only to Cyber Monday 2019. Building upon this momentum, 2021 Cyber Monday was expected to eclipse every previous day of online shopping sales.

Overall, the story for the U.S. economy was looking solid. The National Retail Federation predicted that combined online and offline holiday sales during November and December would increase between 3.6% and 5.2% over 2019 to around $760 billion.

Ecommerce channel advertising (ECA)—primarily led by Amazon Advertising—was one of the fastest-growing ad channels. The primary benefit for marketers using ECA is reaching consumers at the very bottom of the funnel with highly targeted ads as they shop in online marketplaces.

Source: Black Friday 2020 Results, Skai

Advertisers heavily relied on social advertising to drive pre-Black Friday awareness and interest.

One trend to watch going into the holiday season was whether or not advertisers adapted to fewer days between Thanksgiving and Christmas by “heavying up” on ad spending before sitting down for turkey. As it turns out, only social product advertising spend fit that pattern, ending up 26% higher in 2019 versus 2018 based on the pre-Thanksgiving November daily average. No such trend emerged for either ecommerce channel ads or search shopping campaigns.

This finding emphasizes social advertising’s ability to stimulate demand, particularly in advance of the increased purchase intent of the long holiday shopping weekend. While search advertising and ECA are strong bottom-funnel tactics, to reach consumers, they either require shoppers to actively research keywords on a search engine or visit an online marketplace.

Social advertising, however, can be pushed to people who are less engaged in product research. This, combined with its unparalleled consumer data, engaging ad formats, and massive scale make it a valuable top- and mid-funnel opportunity to drive interest and awareness before key holiday dates.

It is also why more than half of the $57 billion spent on programmatic digital display advertising this year will go to social ads.

One of the storylines of the pandemic has been the rise of mobile usage, especially mobile commerce. Mobile consumer spending rose across all categories but was generally led by retail, grocery, food delivery, and entertainment.

According to AdWeek, consumers also turned to mobile shopping for their Black Friday purchases with 40% of purchases — $3.6 billion — made on smartphones, a 23% increase year-over-year.

Black Friday media spending reflected this trend, with 54% of the day’s spending in Paid Search — digital advertising’s biggest channel — going to mobile phones.

Biggest industry spenders by channel

Across Skai’s ecommerce clients, nearly half of total spending on Black Friday came from the categories of Beauty & Personal Care (24%) and Computers & Consumer Electronics (21%).

For Search shopping and retail accounts, the largest share of spending was the more general Retailers & General Merchandise category (43%), while the highest-spending category across Social Advertising was Sports & Fitness (40%).

The Apparel category was second-highest in both Search and Social, with 25% and 21% of total spend, respectively.

Trends in Ad Pricing: a new normal vs. betting big

Compared to last year, trends across Paid Search and Ecommerce Channel Ads on Black Friday were really a tale of two channels.

In Paid Search, same-advertiser spending for Black Friday 2020 increased by just 7% compared to 2019, but total clicks increased 24%. That means average cost-per-click decreased, driven in large part by more clicks on mobile shopping campaigns, which have a relatively low CPC, and also showed much less volatility during November compared to previous years. Mobile shopping has matured to the point where it’s more of a default option, and not a spigot that marketers “turn on” for the holidays with much more aggressive bidding.

Ecommerce Channel Advertising, on the other hand, is starting to see more bidding competition during high-demand periods as more and more advertisers get into the space. Click prices were up year-over-year, which led to an overall spending increase by 60% while clicks only grew by 45%.

Black Friday 2019

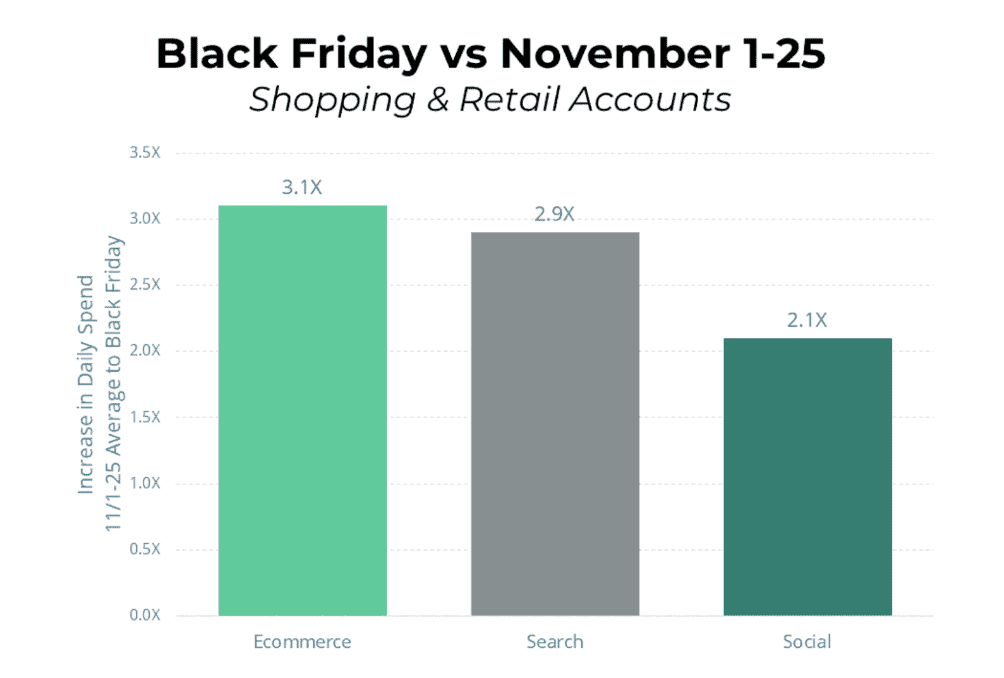

Black Friday 2019 experienced more than triple the average daily advertising spending versus pre-Thanksgiving November across ecommerce advertising (+218% or 3.2x), social product ads (+218% or 3.2x) and search shopping ads (+248% or 3.5x).

Retailers were quick to recognize the ECA opportunity, with Amazon specifically growing faster than any other major ad publisher. In 2017, marketers were still testing the channel, but 2018 showed triple-digit growth as these brands launched sophisticated ECA programs with fully-funded investments. With more major retailers set to launch their ecommerce advertising programs in the near future, the long-term outlook for this channel is strong.

2018’s impressive year-over-year ECA growth demonstrated that retail brands were still ramping up on the channel, while 2019’s double-digit growth on Thanksgiving is more reflective of a mature ad channel rather than a nascent one.

- Spending on Thanksgiving increased 20% on a same-advertiser basis

- Spending on Black Friday increased 30% on a same-advertiser basis

As a result of this increased advertiser attention, Ecommerce Channel Advertising costs went up due to more competition in the market. CPC was up 10% on Thanksgiving in the channel compared to the rest of November and up 29% on Black Friday.

Methodology

The advertising performance data used for this analysis consisted of Skai advertiser clients. The analysis is based on performance data on the Skai platform for accounts with continuous daily spending throughout the relevant holiday seasons. Search and social data takes into account advertisers categorized as retail/ecommerce only.

As part of the dataset used for this analysis:

- Advertiser campaigns across search, social, and ecommerce advertising generated nearly 2 billion impressions per minute across Thanksgiving and Black Friday 2019

- Over half a billion dollars in advertiser spending in November 2019

- Over $50M in spending on Thanksgiving and Black Friday alone at a rate of over $1 million per hour

Skai keeps you on top of digital advertising industry trends with benchmarks & analysis

For more digital advertising insights throughout the year, please visit the Skai blog, reports, case studies, and our Quarterly Trends research hub.