Summary

AI Overviews are now a permanent fixture on Google’s search results, changing how users interact with content and how marketers fight for attention. Based on over eight billion impressions across key industries, 2025 data shows that AI Overviews reduce click-through rates on both organic and paid listings, drive up cost-per-click, and reshape user intent. Marketers must now build strategies that complement AI summaries, prioritizing credibility, depth, and high-intent opportunities, to stay competitive in search.

When Google rolled out AI Overviews globally last year, it marked one of the most significant shifts in modern search. What started as an experiment quickly became the foundation for how people discover, evaluate, and act on information. In our 2024 analysis, we noted how this new AI layer was already reshaping visibility by pushing organic and paid results below summaries that often answer a query before a user ever clicks.

That transformation has only accelerated, and the search landscape now looks fundamentally different. Every marketer feels it: visibility, engagement, and cost are no longer simple equations. The data confirms what intuition already suggested.

Our new 2025 analysis, covering more than eight billion impressions across six major verticals, reveals how AI Overviews have compressed search into fewer, higher-intent interactions. Every click costs more, carries more meaning, and demands sharper precision to earn.

Three key takeaways from what we’re seeing now:

- Search behavior is diverging. Paid queries are shorter and more transactional, while organic ones are longer and more exploratory. AI Overviews mainly appear on informational results, but now influence intent across both paid and organic search.

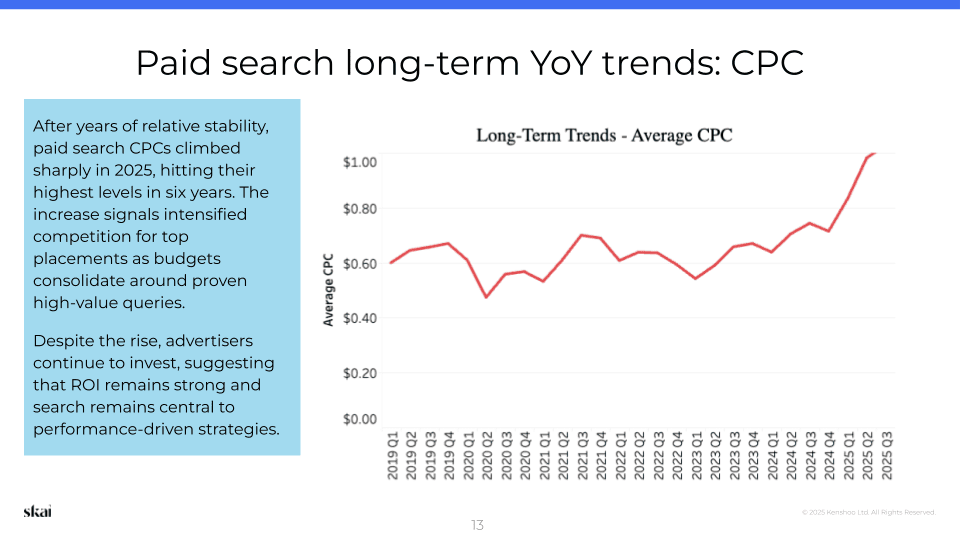

- Clicks are harder to earn and more expensive. Paid CTRs continue to decline while CPCs reach a six-year high, signaling that advertisers are spending more to capture fewer, high-intent interactions.

- Credibility is fueling organic recovery. In categories like Health, Beauty, and B2B, users still seek authoritative sources to verify what AI summarizes, rewarding brands that provide trustworthy, detailed content.

AI Overviews: what we know in 2025

The short answer is often enough to matter in every marketing plan.

AI Overviews are no longer an occasional test feature; they have become a defining part of the results page. While estimates vary, the trend points to consistent expansion across both desktop and mobile. The main takeaway is not the exact percentage of queries that include them, but the permanence of their role. For marketers, that means every campaign, keyword, and content strategy now operates in an environment where Google’s AI can rewrite the first impression. The search results page is no longer a simple list of links. It is a layered system where AI interpretation sits between intent and action.

How often are they showing up?

Google hasn’t released this information, but here’s what some of our peers have found:

- Conductor (July 2025): Found AI Overviews on 16% of 118 million keywords, showing consistent growth over the year.

- SE Ranking (May 2025): Detected AI Overviews in around 30% of tracked U.S. keywords, the highest observed share to date.

- Semrush / Datos (March 2025): Reported AI Overviews on 13.14% of U.S. desktop searches, up from 6.49% in January.

- Exploding Topics (mid-2025): Estimates roughly 15% of SERPs now include AI Overviews globally.

Each dataset measures a different slice of the market, but they all point in the same direction: AI Overviews are growing steadily, appearing in as few as 1 in 7 and as many as 1 in 3 search results.

The new rhythm of search: shorter, sharper, faster

A year into AI Overviews, search behavior has settled into a new pattern. With AIOs satisfying informational intent, paid search is increasingly dominated by concise, transactional queries. People are typing less and expecting Google’s AI to interpret intent on their behalf. Paid queries are shorter, phrasing is simpler, and users trust that the AI layer will surface what matters most without extra effort.

This shift has compressed the search experience. Ahrefs found that when an AI Overview appears, the CTR for the top organic result drops by roughly 34.5% on informational queries. Instead of scanning multiple listings, users often stop at the AI summary. Search isn’t fading; it’s simply finishing faster.

For marketers, this means organic clicks now come from users who are already committed to learning more. Success depends on content that delivers unique value beyond the AI response, credible expertise, richer context, or data that deepens understanding rather than repeating it.

Paid search costs are climbing faster than clicks

The economic signal is clear. Paid search CPCs continue to rise while paid CTRs decline. Skai’s Q3 2025 Digital Advertising Trends Report shows average CPCs at their highest level in six years, confirming what many advertisers already see in their own performance data.

This shift represents more than cost pressure. As AI Overviews take up more real estate on the results page, fewer paid placements appear above the fold. Impression share tightens, and competition intensifies. Budgets are consolidating around the most reliable, high-intent opportunities, leading to a smaller but more expensive share of clicks.

Industrywide, the pattern holds. BrightEdge found that overall search impressions are up nearly 50% year over year, yet paid CTRs are down roughly one-third. Visibility is still achievable, but it now costs more. Advertisers are spending more to reach users who are further along in the purchase journey, where intent is most evident and ROI is most defensible.

How AI Overviews are reshaping the SERP by vertical

The impact of AI Overviews isn’t uniform. Each industry is experiencing the shift in its own way, shaped by how easily AI can satisfy user intent. In some categories, like Food or Beauty, quick summaries answer most surface-level questions. In others, such as Health or B2B, users still rely on expert detail and human authority before taking action. Across both paid and organic search, these differences reveal where AI accelerates decision-making, and where it still needs a human touch.

Health: The last frontier of human trust

AI Overviews summarize symptoms, conditions, and treatments quickly, but users rarely stop there. They still seek reassurance, context, and validation from experts. Paid CTRs declined in 2025, yet organic CTR improved, driven by longer queries and return visits to authoritative sites.

Brands publishing medically reviewed articles or partnering with credible organizations are gaining visibility in both AI summaries and traditional listings. Users hover on AI answers for fast facts, then click through to confirm. It’s a new two-step behavior: skim, then verify.

For healthcare advertisers, performance now hinges on transparency. Schema markup for review authors, plain-language summaries, and transparent sourcing all influence AI inclusion and click behavior. Content that reads “expert yet approachable” resonates far more than optimized jargon.

Beauty and personal care: Depth quietly wins

Beauty searches illustrate the paradox of AI convenience. The summaries answer quick questions (best serums for 2025; how to layer SPF) but lack the storytelling that drives emotional connection. Organic CTR grew this year as consumers revisited detailed tutorials, ingredient breakdowns, and influencer-backed reviews.

Paid performance remained stable only when the creative matched the educational depth. The top ads often feature specific claims (“clinically tested,” “dermatologist-approved”) and link to immersive content. Audiences still crave proof and personality.

Marketers finding success treat AI as a primer, not a threat. They use top-funnel summaries to spark curiosity, then ensure their brand pages satisfy it. That means investing in rich media, expert commentary, and structured metadata so Google’s AI cites them directly.

Food and grocery: Quick answers, quicker exits

AI Overviews excel at recipes, substitutions, and nutrition comparisons. That’s precisely the challenge. Most top-funnel intent resolves without a click, leaving both paid and organic CTR lower than any other category.

Still, opportunity remains, just not at the surface. Transactional searches like “grocery delivery near me” or “same-day produce deals” continue to perform. These moments are less about curiosity and more about immediacy, where ads with local relevance and inventory data stand out.

Organic strategies are shifting, too. Brands that focus on unique value, provenance, sustainability, or preparation guidance see higher engagement because their content offers what AI can’t replicate: story and context. As shoppers blend recipe discovery with purchase, connecting product pages directly to local availability closes the loop.

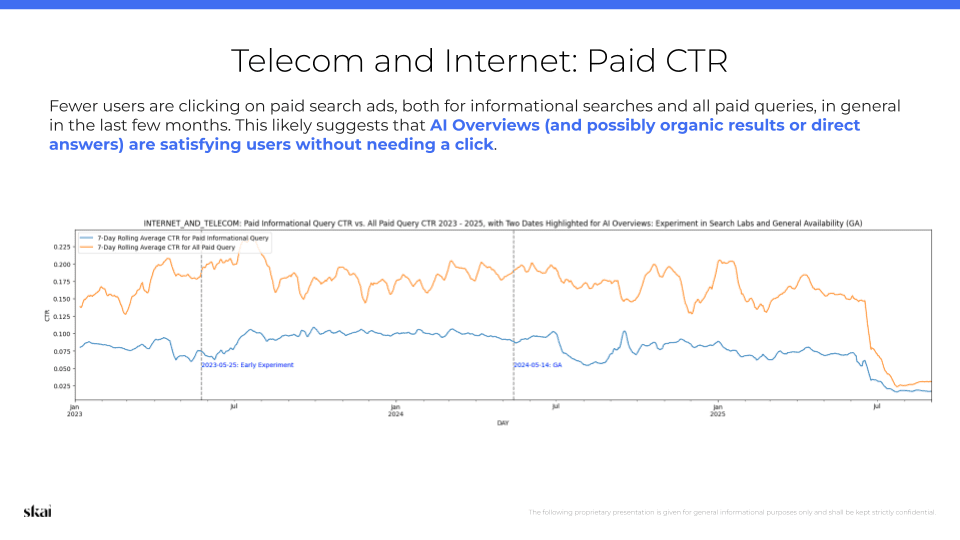

Internet and telecom: Local still matters

Telecom is the outlier where location trumps automation. AI Overviews can summarize plan types, but they can’t guarantee service availability. Paid CTRs stayed flat only because advertisers bid higher on hyper-local terms.

Organic CTR rose slightly as providers refined local landing pages with neighborhood data, coverage maps, and transparent pricing. Google’s AI occasionally quotes these details, but users still click to confirm specifics.

For this vertical, local SEO and structured data remain the difference-makers. Brands aligning metadata to service regions see both higher AI inclusion and better paid efficiency.

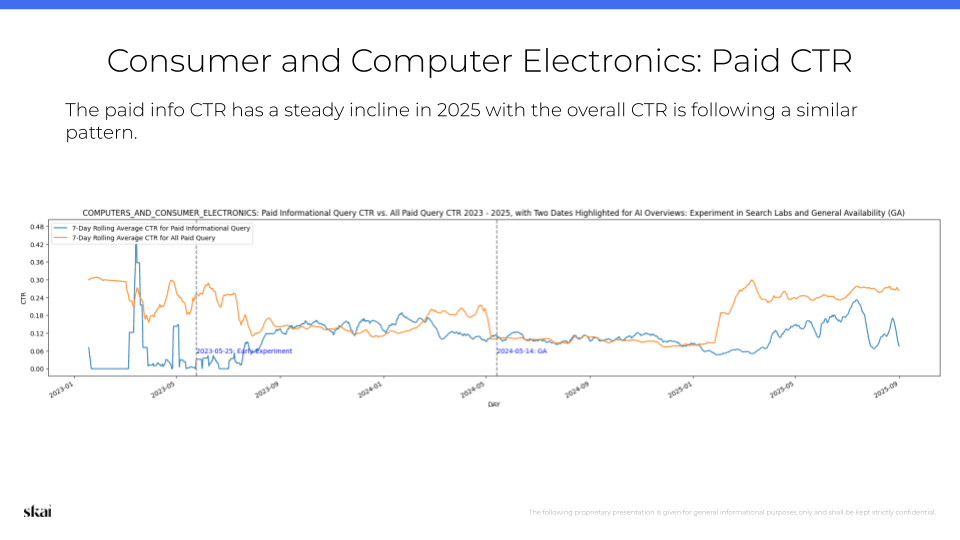

Consumer electronics: The exception continues

Among all categories, consumer electronics remains the one where AI Overviews complement rather than cannibalize results. Shoppers rely on specs, comparisons, and expert reviews, content that AI can summarize but rarely complete.

Paid CTRs increased year over year as brands invested in dynamic product ads and structured data feeds. Organic performance also grew for publishers offering side-by-side testing and unfiltered opinions. AI often surfaces snippets from these sites, reinforcing credibility instead of diverting traffic.

For marketers, the lesson is clarity. Transparent comparison data, strong visual assets, and consistent product availability signals feed both AI visibility and shopper trust. In this vertical, investment in detail pays dividends because users still want to double-check before they buy.

Conclusion: the net result of AI Overviews

One year after launch, AI Overviews have transformed search from a space of exploration into a system of confirmation. Users arrive with stronger intent, act faster, and reward relevance over visibility. Marketers aren’t losing opportunities; they’re competing for fewer, more meaningful ones.

Skai’s Paid Search solutions integrate directly with commerce media programs to help teams optimize bidding, budgeting, and forecasting across all major search engines. With real-time insights, predictive modeling, and built-in automation, Skai helps marketers adapt to the AI-shaped marketplace and keep strategy aligned with business goals.

See how your team can navigate this new phase of search. Schedule a quick demo.

Frequently Asked Questions

AI Overviews reduce visibility for traditional organic listings.

Marketers need to focus on unique content, trust signals, and structured data to compete for clicks under this new layer.

Yes, but inclusion depends on content quality and authority.

Structured data, expert sourcing, and clarity all improve chances of being cited.

Fewer paid ads now appear above AI Overviews.

This pushes up CPCs as advertisers compete for limited high-intent placements with better ROI.