Chris "Coz" Costello

Senior Director of Marketing Research @ Skai

Chris "Coz" Costello

Senior Director of Marketing Research @ Skai

November is a huge piece of the end-of-the-year holiday shopping season. Not only do advertisers begin ramping up their spending in the first half of the month, but the entirety of the “Cyber 5” peak period between Thanksgiving and Cyber Monday is typically contained in the second half.

With just one more month left of the year, how much have digital advertising budgets changed, and what has been the impact of the holidays on channel spending and ad costs?

If your brand prospered in November, then December is an opportunity to take what you know worked well and double-down on it. Today’s fast-shipping means that consumers can order later and later, whereas the last day for shipping may have been earlier in previous years. By checking out the benchmarks in this post, you might find some areas of opportunity to exploit in this final sprint.

On the other hand, if your November was a bit underwhelming, that means you still have work to do this month. There is time to make Q4 a success. Try shifting budgets so you can get a bit aggressive in targeting keywords, products, and audiences. Your competitors may have prioritized November in their media plans, providing an opportunity while they potentially take their foot off of the gas pedal. Check your campaign costs and performance daily to ensure that you can react quickly to optimize.

Whichever boat you’re in, we here at Skai wish you good luck in December!

This is a continuation of our monthly paid media snapshot series. As with any benchmark, your mileage may vary, but we hope this provides a bit more context for you as a marketer as you navigate the ups and downs of your program’s performance.

Methodology note. For the purpose of these monthly benchmarks, only Skai accounts with spend above a minimum threshold for the previous three months are included in this analysis.

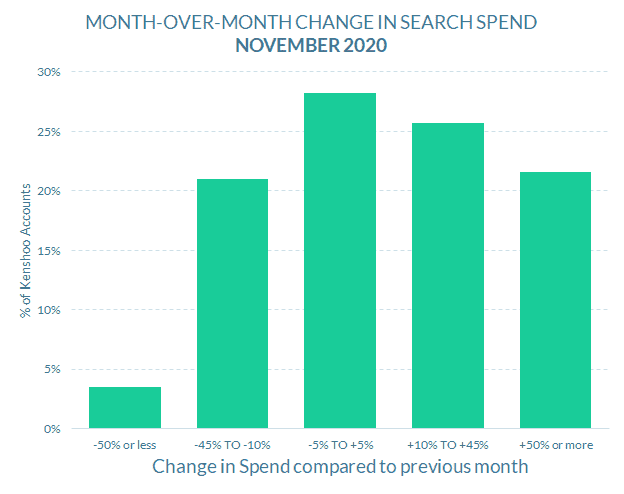

Paid Search spending

The General Retail and Apparel categories saw overall month-over-month spending increases of nearly 2X, leading the holiday charge to bigger budgets compared to October.

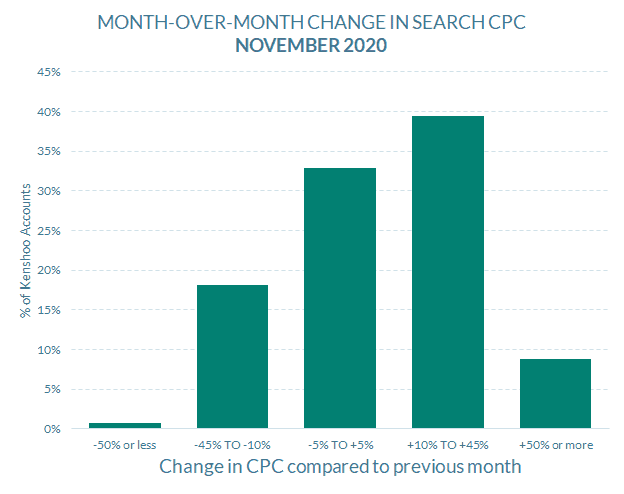

Holiday price premiums kicked in during November, with nearly half of advertisers seeing their average CPC increase compared to October.

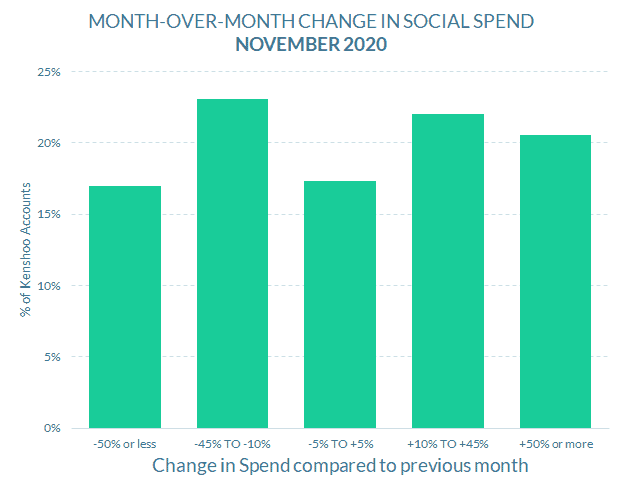

Social budgets were largely split with political spending winding down after the election while retailers ramped up spending for the holidays.

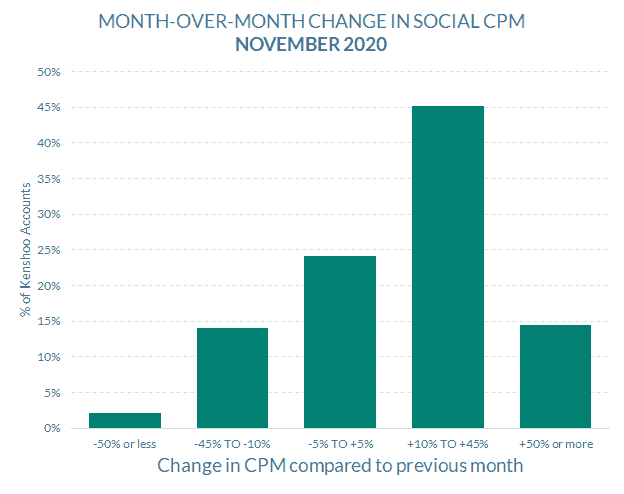

A majority of social accounts paid higher prices per thousand impressions in November vs. October. Increased demand for audiences for both the holidays and for the period just before the election contributed to the hike.

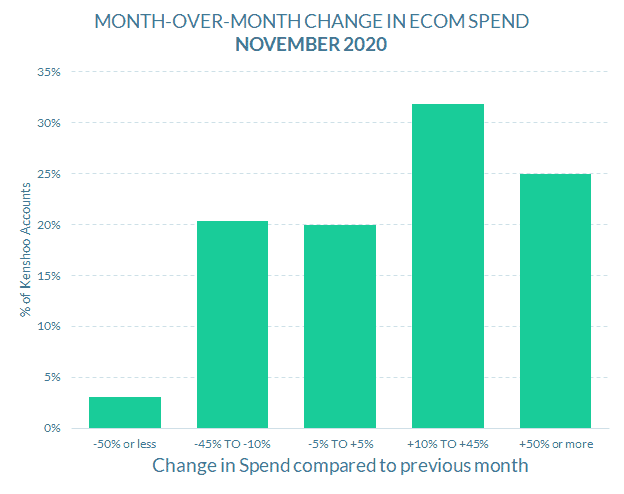

There was still room for Ecommerce advertising budgets to grow in November after an October that featured the rescheduled Amazon Prime Day.

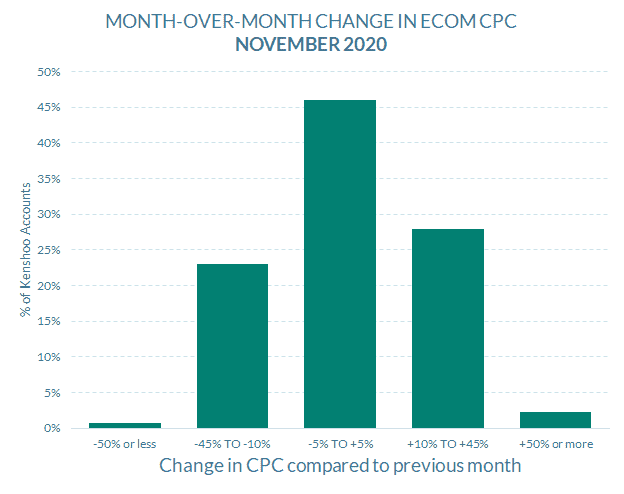

For the most part, click prices in the Ecommerce Advertising Channel were stable, perhaps because of broadly similar price premiums in the previous month for Prime Day.

Come back in December for our next monthly trends post. Until then, you can dive into more of our research via our Quarterly Trends Reports hub and our COVID-19 Marketing Resource Center.

And please visit the Skai blog and Research & Reports page for ongoing insights, analysis, and interviews on all things related to digital advertising.

We use cookies on our website. Some of them are essential, while others help us to improve this website and your experience.

Here you will find an overview of all cookies used. You can give your consent to whole categories or display further information and select certain cookies.